As we edged towards the end of a yet another “unprecedented” year in 2022, debate was raging on how pay-setters should approach pay reviews in the context of the cost-of-living crisis.

The argument went as follows. Yes, workers will need a meaningful uplift in pay to cope in the face of price rises and an uncertain energy market. However, unless this is managed prudently, there is the risk that excessive wage growth will fuel even greater inflation.

So, employers would need to show “restraint” in how they review pay for their staff in 2023.

We did not hear much talk of restrain on how businesses set prices for households / clients.

Commerce 101. The key test to how Business balances it’s costs and revenue is profit. Drilling down further, we can review Margins and what comprises any growth thereon.

Like an old polaroid, a picture is slowly emerging on how that’s went.

The IMF report that 45 per cent of inflation growth since the start of 2022 in Europe is driven by corporate profits.

This, bluntly, suggests that employees and households have been shouldering a disproportionate burden of inflationary increases as profit margin growth outstrips wage growth.

What’s going on in the UK?

“Using the latest available figures for the largest 350 companies on the London stock exchange, Unite the union has shown how profit margins for the first half of 2022 were nearly double—89% higher—than for the same period in 2019, before the pandemic. Unite’s report finds that in the last six months company profits are responsible for almost 60% of inflation.”

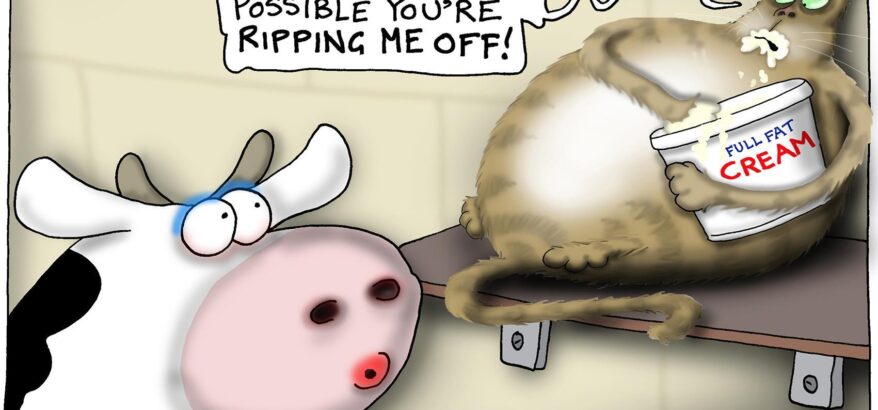

This state is variously referred to as price-gouging, profiteering and greedflation.

As linked below, UKG are beginning to take note.

As we look to 2024, UK mortgage holders are projected to pay an additional £16B in borrowing costs. That’s a cruel impact of the Independent BOE’s attempts to cool inflation via interest rate hikes.

Last year there was a significant intervention in the UK energy market, at huge cost to the taxpayer.

Only last week there were the first tentative moves at engaging with UK Banks on mortgage support. I expect those initial (very light) measures will be revisited without a significant reversal in interest rates.

You can expect other big players such as supermarkets to be called to account for soaring prices.

Beyond that, who knows what other industries will be questioned on how they’re managing prices.

What does this mean for employees?

Pay-setting and Salary reviews have never been more material for UK households. Employees will have greater expectations on how their efforts are remunerated in this economic climate. On the back of navigating the pandemic, and the huge effort that entailed for individuals, the psychological contract was placed under great strain – manifested in the “Great Resignation” and “Quiet Quitting.”

What does this mean for employers?

Well-informed employees appreciate that costs need controlled. But when prices and profits exceed their salary-bump, this begins to impact their ability to maintain a lifestyle, and even afford the basics. It is therefore extremely important that pay discussion are made with reference to company performance in a meaningful and transparent way – ideally this is set out at the beginning of the cycle.

In closing

The outlook continues to be uncertain. Taxpayers funded huge support packages during Covid (to households and businesses) and then again in the fuel crisis. This has a cooling effect on how much the state can do to subsidise households and businesses through any future crisis.

As we sit dead in the middle of 2023, there will be huge focus on how businesses manage salary reviews in the next 12 months. Increasingly, other stakeholders – government, clients/customers, take a keener interest in these processes being fair and transparent.